17

Aug

EUR/USD Daily Market Briefing

Economic Calendar

| Time | Currency | Impact | Description | Previous | Forecast | Actual |

| 4:00 PM | EUR | Medium | Final CPI y/y | 1.3% | 1.3% | |

| EUR | Low | Final Core CPI y/y | 1.2% | 1.2% | -0.4% | |

| EUR | Low | Trade Balance | 19.7B | 20.4B | ||

| 6:30 PM | EUR | Medium | ECB Monetary Policy Meeting Accounts | |||

| 7:30 PM | USD | High | Unemployment Claims | 244K | 240K | |

| USD | Medium | Philly Fed Manufacturing Index | 19.5 | 18.3 | ||

| 8:15 PM | USD | Medium | Capacity Utilization Rate | 76.6% | 76.7% | |

| Medium | Industrial Production m/m | 0.4% | 0.3% | |||

| 11:30 PM | USD | Medium | FOMC Member Kaplan Speaks |

News

Topic: Forex – Dollar weaker after Fed minutes show debate on 3rd hike

- Investing.com- The dollar headed weaker in to Asia on Thursday as Fed minutes showed an increased debate about another rate hike this year.

- Overnight, the dollar traded near three-week highs against a basket of global currency on Wednesday, after recent economic data pointing t a strengthening U.S. economy lifted expectations of a third rate hike later this year.

- The dollar continued its positive start to week, as solid retail sales data on Tuesday overshadowed a slump in U.S. housing data amid growing expectations the Fed will increase interest rates for a third time later this year.

REFERENCE: https://www.investing.com/news/forex-news/forex–dollar-weaker-after-fed-minutes-show-debate-on-3rd-hike-519482

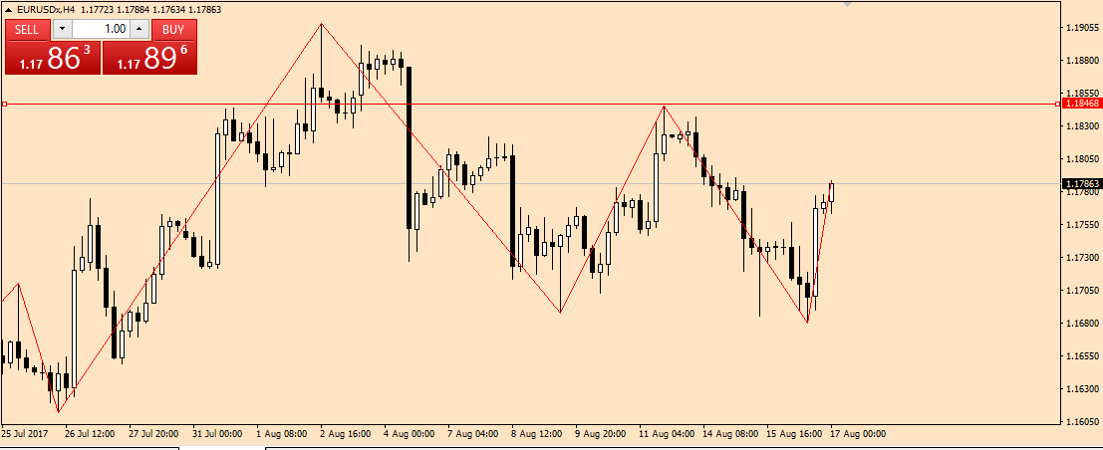

Technical Chart-H4

Support & Resistant

|

Resistant |

Pivot |

Support |

| R1: 1.1803 |

1.1742 |

S1: 1.1706 |

| R2: 1.1838 | S2: 1.1645 | |

| R3: 1.1900 | S3: 1.1609 |

Main Scenario :

Recommendation BUY

Entry Point 1.1803

Take Profit ($300-$500)

Stop Loss $300

Alternative Scenario :

Recommendation SELL

Entry Point 1.1742

Take Profit ($300-$500)

Stop Loss $300